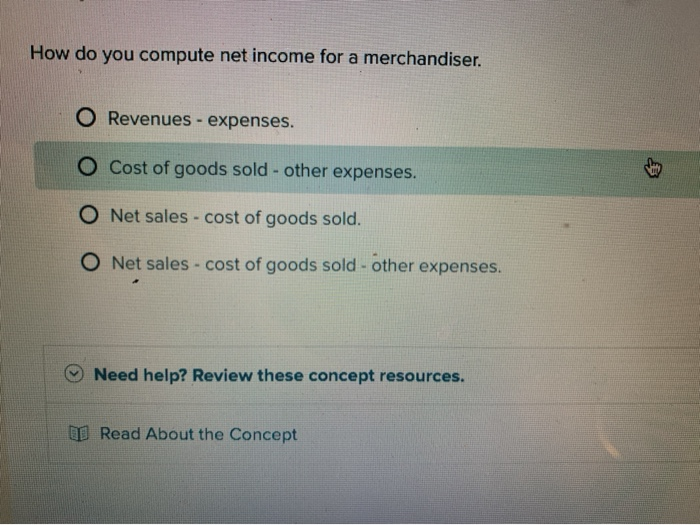

How Do You Compute Net Income for a Merchandiser.

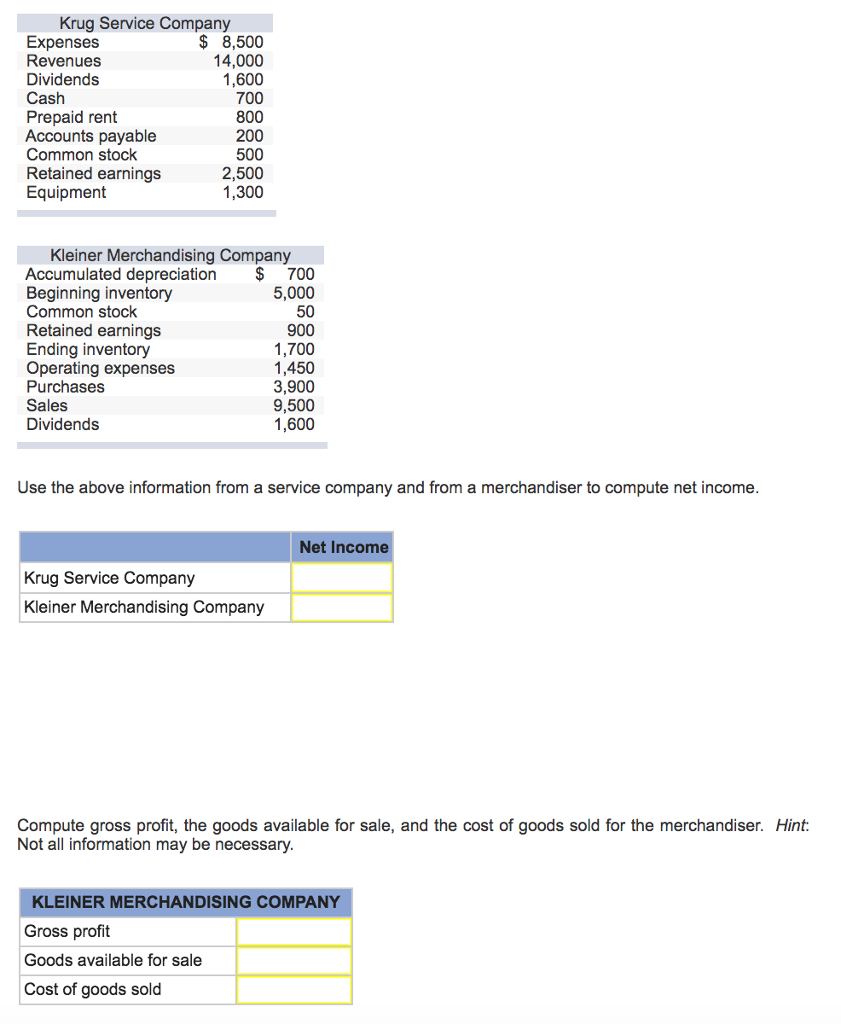

Merchandise inventory is a current asset on the balance sheet of a merchandiser using the periodic inventory system. Ending inventory cost of goods sold Total merch available for sale.

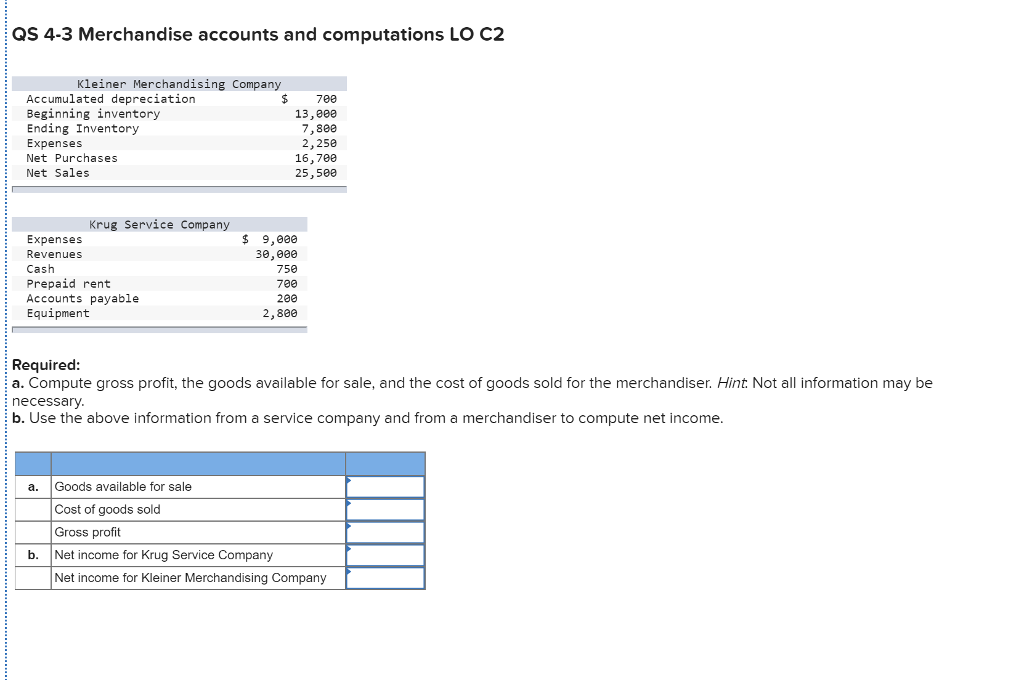

Solved Use The Above Information From A Service Company Chegg Com

Otherwise full payment is expected within 45 days of the invoice date.

. Otherwise full payment is expected within 45 days of the invoice date. O Net sales - cost of goods sold -. How do you compute net income for a merchandiser.

Merchandise inventory is an asset reported on the balance sheet and contains the cost of products purchased for sale. Net Income of the MILO Pvt. O Net sales - cost of goods sold.

Check all that apply The buyer can deduct 2 of the invoice amount if payment is made within 10 days. You need to provide the two inputs ieTotal RevenueandTotal Expense. To compute net income for a merchandiser you will start with net sales subtract cost of goods sold and subtract other expenses Merchandise inventory same as supplies but more detailed term that is still available for sale is considered a n asset and is.

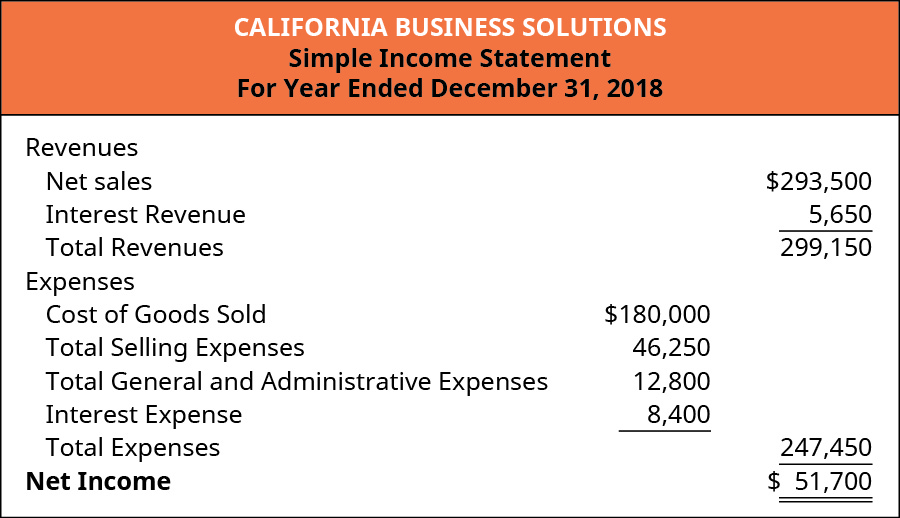

O Revenues - expenses. How do you compute net income for a merchandiser. Net sales - cost of goods sold.

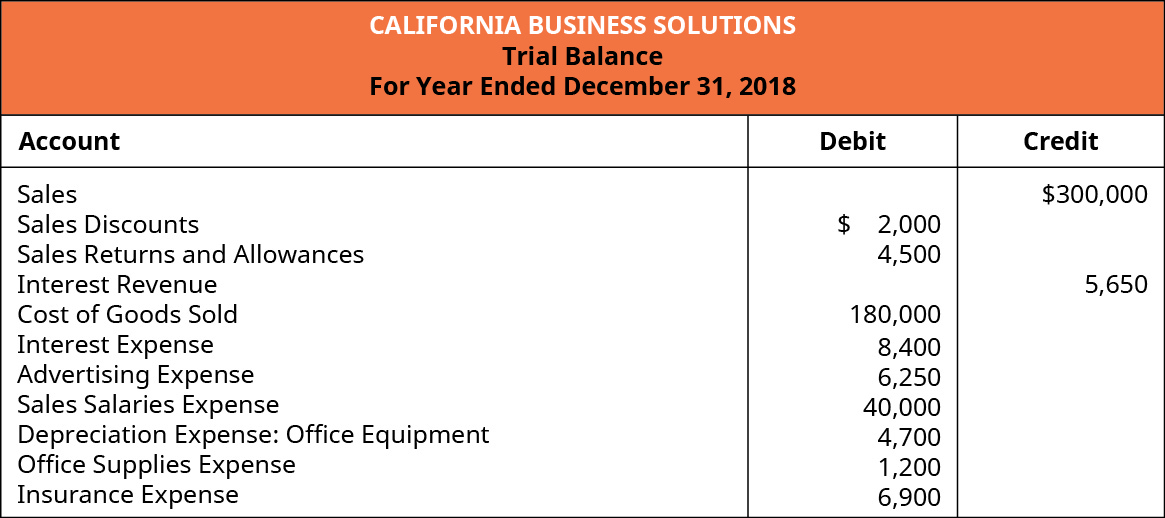

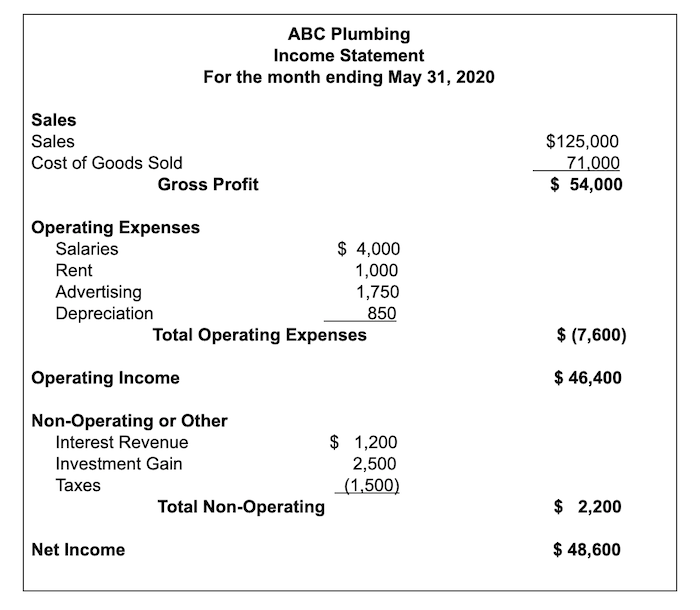

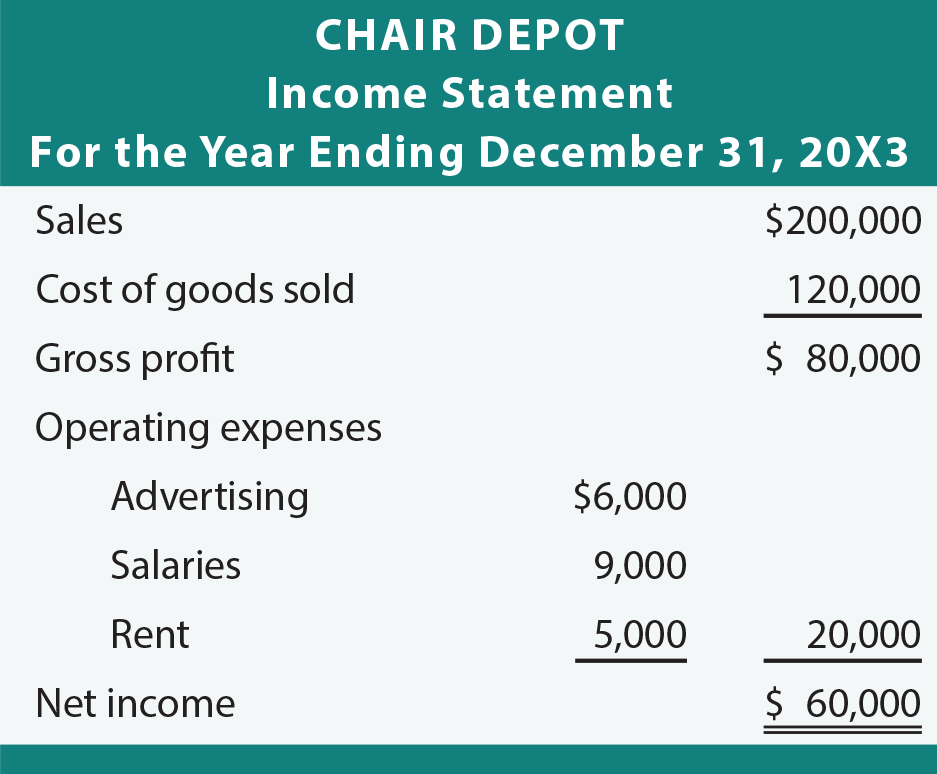

If payment is made on May 28 calculate the purchase discount that may be taken by X - Mart. The buyer can deduct 2 of the invoice amount if. Cost of goods sold is subtracted from net sales in order to determine gross profit.

Beginning inventory net purchases Merchandise available for sale. O Net sales - cost of goods sold other expenses. Identify the statements below which are correct regarding a merchandisers multi-step income statement.

Review the following credit terms and identify the one that states that the buyer will receive a 3 discount if the payment is made within 15 days. Net sales - cost of goods sold - other expenses. Merchandise inventory is subtracted from net sales on the income statement to determine gross profit for the period.

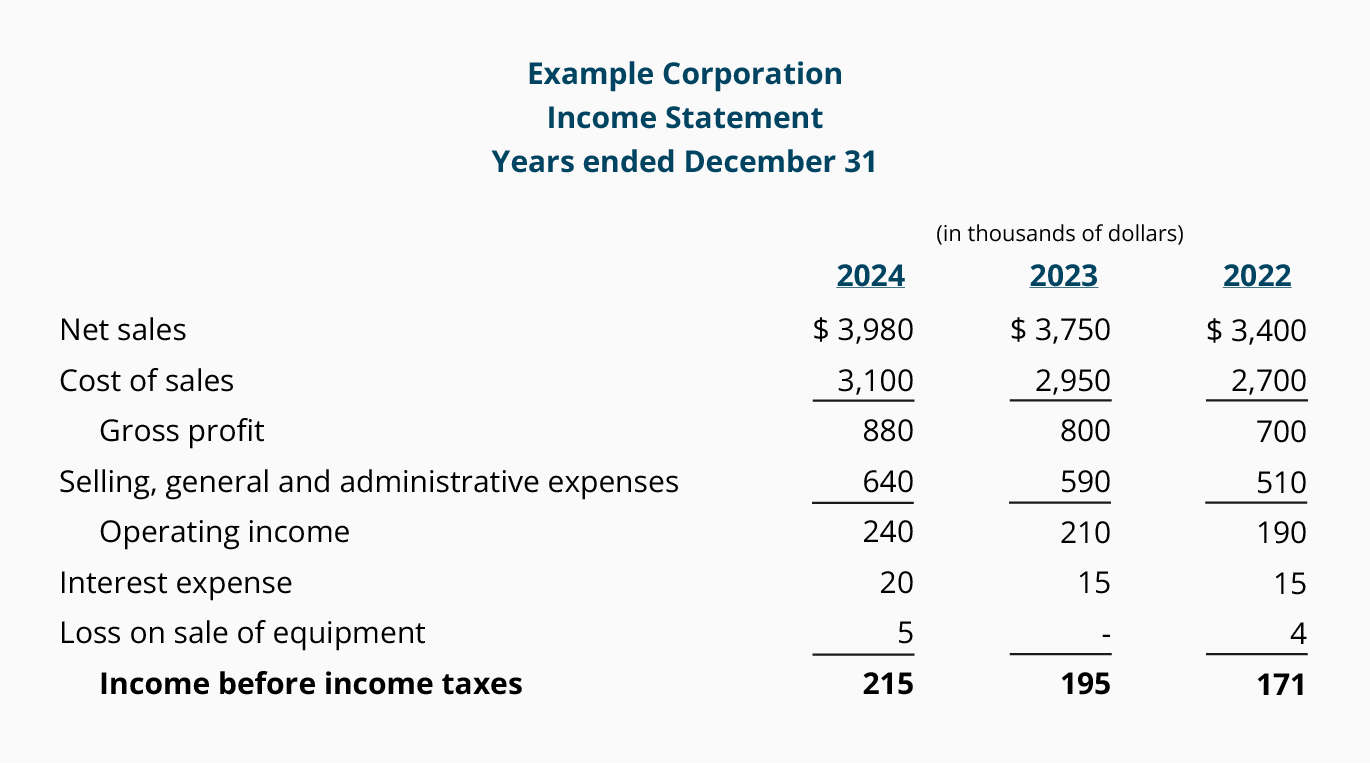

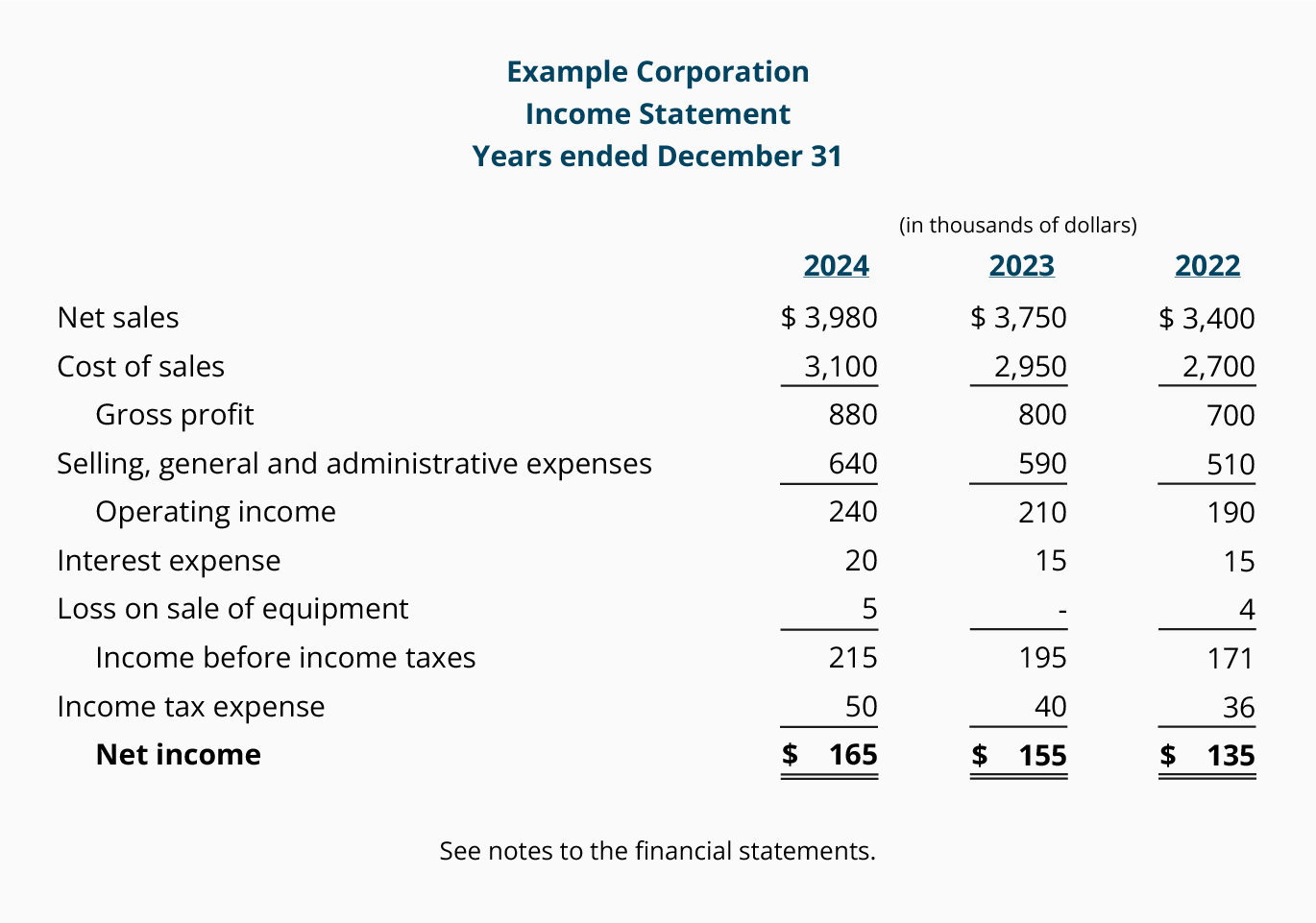

315n45 Explain what the credit terms of 210n30 mean. Expenses are subtracted from gross profit in order to calculate net income. Its been a long strange journey to get here but we are finally ready to do our income statement.

This is called the traditional format income statement. The net income results from operations plus other revenues. O Cost of goods sold - other expenses.

To figure out what other revenues or expenses make up the total take total other revenues expenses. Chapter 3 chapter reading questionsassignment to compute net income for merchandiser you will start with net sales subtract cost of goods sold and subtract. Is Calculated as-Net Income of the company is calculated as-.

Net sales - cost of goods sold - other expenses net income. This is the computation of net income for a service company. Here we will do the same example of the Net Income formula in Excel.

How do you compute net income for a merchandiser. Once you have cost of goods sold the rest of the statement is fairly easy. Cost of goods sold - other expenses.

O Net sales - cost of goods sold. On May 14 X - Mart purchased 500 of merchandise with terms of 315n40. O Revenues - expenses.

How do you compute net income for a merchandiser O Cost of goods sold other expenses. Explain what the credit terms of 210n30 mean. Review the following credit terms and identify the one that states that the buyer will receive a 3 discount if the payment is made within 15.

It is very easy and simple. Here is the format. Merch that is sold becomes an expense reported on the income statement.

Selling and Administrative Expenses Operating Income. To compute net income for a merchandiser you will start with net sales subtract cost of goods sold and subtract other _ _____. Cost of Goods Sold Gross Profit Less.

How do you calculate net income for a merchandiser. You can easily calculate the Net Income using the Formula in the template provided. Check all that apply The full payment is due within 10 days.

Equals revenues from selling merchandise minus both the cost of merchandise sold to customers and other expenses for. Other expenses must also be subtracted. How Do You Compute Net Income For A Merchandise.

Merch purchased is an expense and is reported on the income statement. To compute net income for a merchandiser you will start with net sales subtract cost of goods sold and subtract other _____.

Solved How Do You Compute Net Income For A Merchandiser O Chegg Com

Components Of The Income Statement Accountingcoach

Solved In The Blank Question To Compute Net Income For A Chegg Com

Acc 202 Merchandising Finding Missing Amount On Income Statement Youtube

A Beginner S Guide To The Multi Step Income Statement The Blueprint

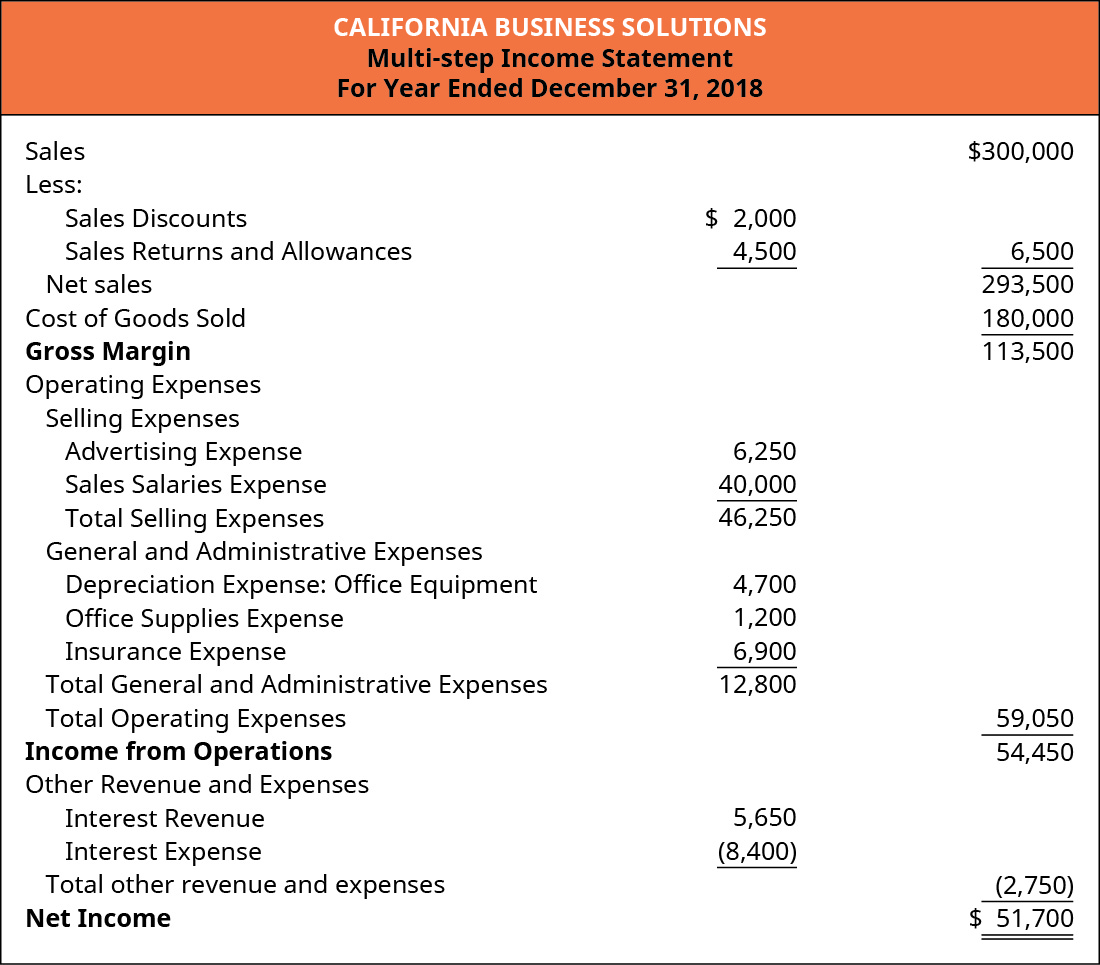

Describe And Prepare Multi Step And Simple Income Statements For Merchandising Companies Principles Of Accounting Volume 1 Financial Accounting

The Merchandising Operation Sales Principlesofaccounting Com

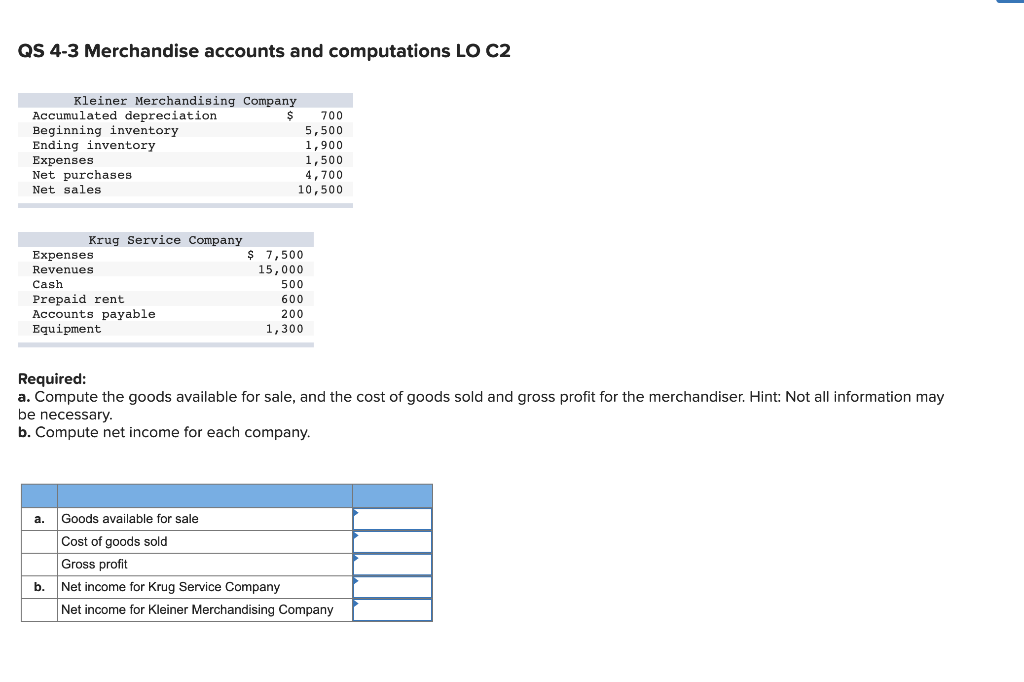

Solved Qs 4 3 Merchandise Accounts And Computations Lo C2 Chegg Com

Describe And Prepare Multi Step And Simple Income Statements For Merchandising Companies Principles Of Accounting Volume 1 Financial Accounting

Multi Step Income Statement An In Depth Financial Reporting Guide Freshbooks Resource Hub

Solved Qs 4 3 Merchandise Accounts And Computations Lo C2 Chegg Com

Net Income Gross Profit And Net Profit Formulas

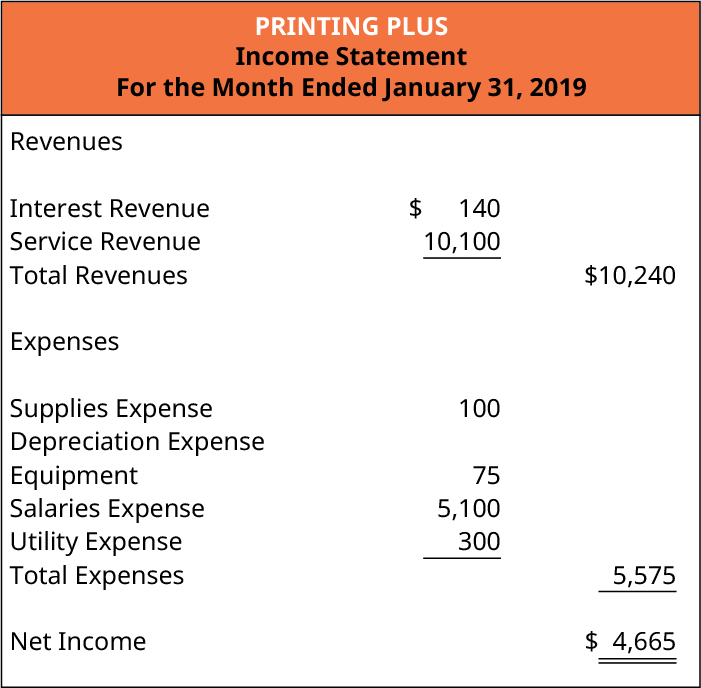

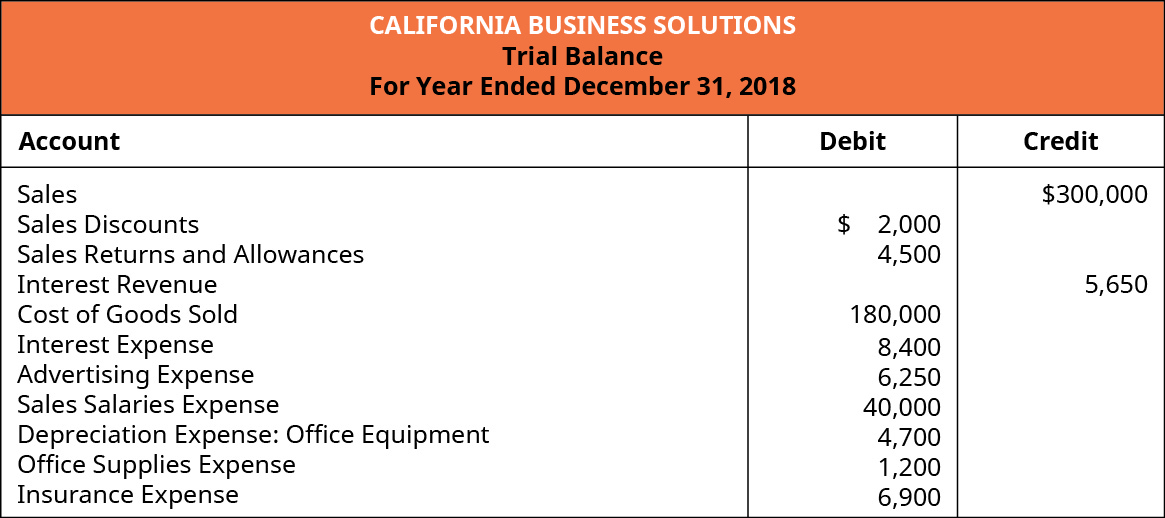

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Components Of The Income Statement Accountingcoach

Merchandising Financial Statements Course Hero

Describe And Prepare Multi Step And Simple Income Statements For Merchandising Companies Principles Of Accounting Volume 1 Financial Accounting

Income Statement Merchandising Operations Net Sales Gross Profit Net Income Youtube

Profit And Loss Account Profit And Loss Statement Accounting Financial Health

Comments

Post a Comment